The Invisible Enemy (Inflation)

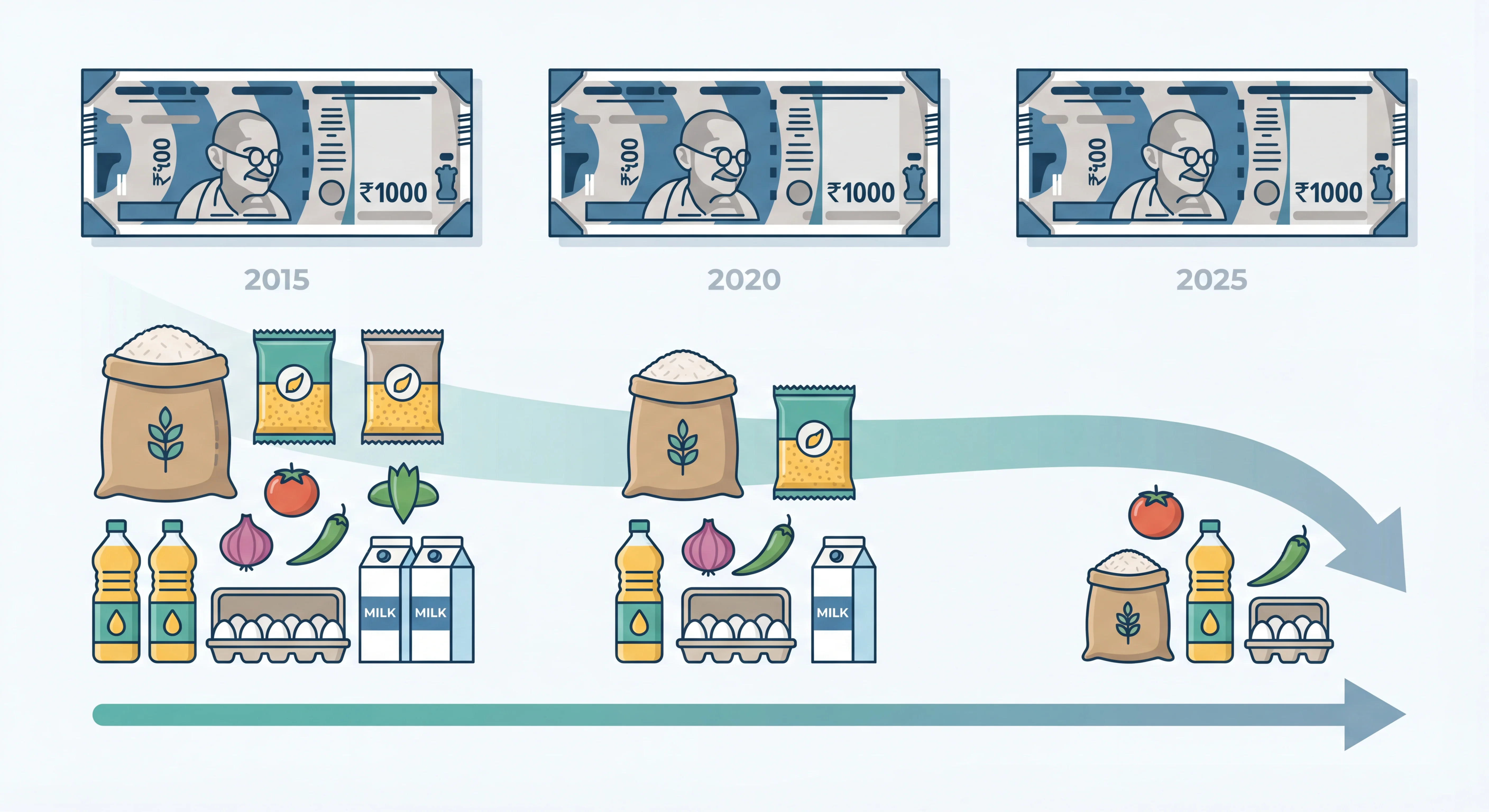

Understand inflation through everyday Indian examples. See why the same rupee amount buys less over time and what this means for your financial decisions.

TL;DR: How to Think Differently

- Your money is quietly losing value while sitting still — every day it buys a little less than it did yesterday

- ₹10,000 today and ₹10,000 five years from now are not the same thing even though they look identical in your bank account

- "Saving" money without growing it is actually watching it shrink in real purchasing power

- The price increases you notice aren't random bad luck — they're the visible face of an invisible, continuous process

- Inflation doesn't announce itself; it accumulates — by the time you feel it strongly, years of erosion have already happened

- The question isn't whether inflation will affect you — it's whether you're seeing it clearly enough to respond

Who This Is For

This is for anyone who has ever thought, "Wasn't this cheaper last year?"

If you've noticed that your grocery bill keeps creeping up even though you buy the same things, this is for you. If you've felt like your salary increase doesn't actually make life easier, this is for you. If you've saved money in a bank account for years and feel vaguely disappointed by how little it seems to matter, this is for you.

This is especially for people who think "saving" means putting money aside and leaving it untouched. They don't realize what's happening to it while it sits there.

You're not imagining it. Prices are rising. Your money is buying less. And it's not a conspiracy or bad luck. It's a fundamental economic reality that most people don't see clearly until it's too late to adjust for it.

The Samosa That Costs ₹20

Let's start with something specific.

Think about the price of a samosa. Or a vada pav. Or a cup of chai at your local tea stall.

Ten years ago, maybe you paid ₹5 for a samosa. Five years ago, ₹10. Today, ₹20. In some places, ₹25.

Your first reaction is probably: "Things are getting expensive."

That's true. But here's a different way to think about it:

The samosa didn't change. Your money did.

The samosa is the same size. Same ingredients. Same vendor, probably. What changed is how much of your money it takes to buy it.

Another way to say this: your money is worth less.

In 2014, ₹20 could buy you four samosas. Today, ₹20 buys you one.

The ₹20 note looks the same. It has the same numbers printed on it. It sits in your wallet the same way.

But it's worth 75% less in samosa-purchasing-power.

This is inflation.

Not the official number you hear in the news. Not the economic theory. Just this: the same money buys less over time.

[!NOTE] Prices mentioned in this article are illustrative examples based on typical urban Indian markets. Actual prices vary by location and time period.

What's Actually Happening

Inflation is the continuous, gradual increase in the general price level of goods and services.

Let's break that down without jargon:

"Continuous" — It doesn't stop. It's happening right now, as you read this. Tomorrow. Next month. Next year.

"Gradual" — You don't notice it day to day. You notice it when you compare across months or years.

"General price level" — It's not just one thing getting expensive. It's most things, on average.

So, when the newspaper says "inflation is 6%," what they mean is: on average, across many goods and services, prices went up 6% this year.

Which means your money lost 6% of its purchasing power this year.

If you had ₹100 at the start of the year and you kept it in your wallet, untouched, you still have ₹100 at year-end.

But what that ₹100 can buy is now worth ₹94.

The number didn't change. The value did.

This is why inflation is invisible. You look at your bank balance and see ₹50,000. The number ₹50,000 stays ₹50,000. Your brain reads this as "my money is safe."

But that ₹50,000 is buying less this year than it did last year. And next year, it will buy even less.

The enemy isn't the rising prices. The enemy is the falling value of your money.

Where You See It (If You're Looking)

Inflation shows up everywhere, but we experience it differently in different parts of life.

The Grocery Bill

You buy the same items every week. Rice, dal, vegetables, milk, eggs, oil.

Your bill used to be ₹1,200. Then ₹1,400. Now ₹1,600.

You didn't start buying luxury items. You didn't double your portions. The same basket of goods just costs more.

This is inflation hitting daily necessities.

School Fees

Your child's school fee was ₹60,000 a year when they joined five years ago.

Now it's ₹95,000. For the same school. Same quality of education, probably.

The increase feels unfair. But the school's costs also went up—salaries, rent, supplies.

This is inflation hitting big annual expenses.

The Auto Ride

The minimum auto fare in your city was ₹18 a few years ago. Then ₹21. Now ₹25.

Same distance. Same auto. More money.

This is inflation hitting transportation.

Medical Costs

A doctor's consultation was ₹300. Now it's ₹500. Blood test packages that cost ₹800 now cost ₹1,200.

This is inflation hitting healthcare—and it often runs higher than average inflation.

Your Salary

Here's where it gets interesting.

Your salary was ₹50,000 five years ago. Now it's ₹70,000. That's a 40% increase. You should be doing better, right?

Except prices have also gone up 30-40% in many categories.

So, your salary increased in number, but your purchasing power didn't increase as much as you think.

This is why getting a raise doesn't always feel like getting ahead.

What People Get Wrong About This

"Inflation only matters for poor people"

Not true.

Inflation affects everyone, but differently.

If you earn ₹30,000 a month and your grocery bill goes up ₹2,000, that's a huge hit. If you earn ₹2,00,000 a month, ₹2,000 is barely noticeable.

But here's what people miss: inflation also affects your long-term goals.

If you're saving ₹10 lakhs for your child's education in 10 years, and education costs inflate at 8% per year, you're not actually getting closer to the goal. Your savings must grow faster than 8%.

Rich people lose purchasing power too—they just notice it differently.

"My fixed deposit is growing, so I'm beating inflation"

Your FD gives you 6.5% interest.

Inflation is 6%.

You think: "Great, I'm earning 0.5% above inflation."

Except you pay tax on the 6.5% interest. If you're in the 30% tax bracket, your post-tax return is 4.55%.

Inflation is 6%.

You're actually losing 1.45% of purchasing power every year, even though your bank balance is growing.

The number in your account increases, but what it can buy decreases.

"Inflation is temporary—prices will come back down"

This almost never happens.

Prices can stabilize (inflation slows down), but they rarely decrease across the board (that's deflation, which is actually concerning for other reasons).

Once tomatoes go from ₹40/kg to ₹80/kg, they might come back down to ₹60/kg. But they're not going back to ₹40.

The general trend is always upward. The question is just how fast.

"I'll worry about inflation when I retire"

Inflation is eating your money right now.

If you're 30 and retirement is 30 years away, and you're saving ₹10,000/month in an account that earns 5% when inflation is 6%, you're actually going backward in purchasing power every single month.

By the time you retire, your "savings" will be worth much less than you think.

Inflation doesn't wait for retirement to matter. It's compounding against you starting today.

"If I just don't spend, inflation can't hurt me"

Your money sitting in your bank account is losing value whether you spend it or not.

Not spending doesn't protect you from inflation. It just means you're watching your purchasing power erode without even getting the benefit of consuming anything.

Inflation penalizes money that sits still.

The Two Stories Your Money Tells

Here's a useful way to think about this:

Every amount of money tells two stories.

Story 1: The Nominal Amount

This is the number. ₹50,000. ₹10 lakhs. ₹1 crore.

This is what you see in your bank statement. This is what you tell people when they ask how much you saved. This is what feels safe and measurable.

Story 2: The Real Value (Purchasing Power)

This is what that money can actually buy.

₹10 lakhs today can buy you a certain amount of goods and services.

₹10 lakhs ten years from now will buy you significantly less.

The nominal amount stays the same. The real value changes.

Your brain naturally focuses on Story 1 because it's visible and concrete.

But Story 2 is what actually matters for your life.

When you retire, you don't care that you have ₹1 crore in the bank. You care whether ₹1 crore can pay for your living expenses.

Inflation is the gap between these two stories.

Why This Feels Invisible

Inflation is hard to notice for three reasons:

1. It's Gradual

If prices doubled overnight, you'd notice immediately and adjust.

But 6% a year? That's 0.5% per month. That's invisible day to day.

You don't notice the ₹5 increase in your grocery bill this week. But after a year, the ₹250 increase is noticeable. After five years, it's undeniable.

By the time you feel it, it's already been happening for a long time.

2. Nominal Numbers Stay Stable

Your bank account shows ₹2 lakhs.

Next year, it still shows ₹2 lakhs (if you didn't add or spend).

The number gives you a false sense of security.

Your brain interprets "same number" as "same value," but that's not true.

3. Price Increases Feel Like Individual Events

Tomatoes got expensive because of bad weather.

Petrol got expensive because of global oil prices.

School fees went up because the school is greedy.

You explain each price increase with a specific story. And each story feels true.

But when you zoom out, you see: everything is getting more expensive at roughly the same pace, because money is losing value.

How to Think About This Going Forward

Money Is Not Static

Stop thinking of money as a fixed store of value.

Money is more like ice. If you leave it sitting, it melts.

Slowly. Invisibly. But continuously.

The question is never "Should I save money?" The question is "Where should I put my money so it doesn't lose value while I save it?"

The Inflation-Adjusted Lens

Whenever you think about a future cost—your child's education, your retirement, a house—don't think in today's prices.

Think: "What will this cost in 10 years?"

If something costs ₹10 lakhs today and education inflation runs at 8%, in 10 years it will cost ₹21.6 lakhs.

Planning with today's numbers is planning to fail.

The Real Question for Your Money

It's not "Is this safe?"

It's "Is this growing faster than inflation?"

A bank account is safe from loss. But it's not safe from inflation.

A fixed deposit is safe from loss. But it's not safe from inflation (especially after tax).

Safety from loss and safety from inflation are two different things.

Today's Surplus Is Tomorrow's Baseline

If you're comfortable today spending ₹40,000 a month, you might think: "In retirement, I'll need ₹40,000 a month."

Wrong.

If you retire in 20 years and inflation averages 6%, you'll need ₹1,28,000/month just to maintain the same lifestyle.

Your future needs aren't your current needs. They're your current needs adjusted for 20 years of inflation.

What This Connects To

This isn't just abstract economics. Inflation is why:

- You can't just save money and feel secure

- You need your money to grow, not just sit

- Long-term goals require inflation-adjusted planning

- Fixed deposits might feel safe but aren't enough

- Time is both your friend (for compounding) and your enemy (for inflation)

Later, you'll learn how to think about investments that can beat inflation. You'll learn about real returns versus nominal returns. You'll learn to plan for goals with inflation built into the projections.

But all of that starts here, with this awareness:

Your money is losing value right now. Not because you're spending it. Because time is passing.

This realization doesn't require you to do anything immediately. It just requires you to see what's happening.

Because once you see it, you can't unsee it.

And that's when you start making different choices.

The Shift

Inflation is called the invisible enemy because it doesn't feel like an enemy.

It doesn't attack. It doesn't announce itself. It doesn't create a crisis.

It just quietly, steadily, relentlessly erodes the value of money that's sitting still.

The samosa that costs ₹20 today will cost ₹25 in a few years. Then ₹30. Then ₹35.

The school fee that's ₹95,000 today will be ₹1,50,000 in eight years.

The retirement lifestyle that costs ₹50,000/month today will cost ₹1,50,000/month in 20 years.

And if your money isn't growing to keep pace, you're not standing still. You're falling behind.

This isn't about fear. It's about seeing clearly.

The number in your bank account will keep looking the same. But what it can buy will keep shrinking.

Once you understand that, everything about money starts to make sense.

Why people invest. Why they take risks. Why they can't just save in a bank and call it done.

Not because they're greedy. Not because they're gambling.

But because standing still, financially, means moving backward.

Inflation doesn't care about your intentions. It doesn't care that you're being responsible by saving.

It just keeps working. Every day. Every year.

The only question is: are you seeing it?

Actionable

The Personal Inflation Tracker

This exercise is about making inflation visible in your own life.

Observation List:

- 1Choose 5-7 things you buy regularly (staples, transport, eating out, services)

- 2Think back 3-5 years and find/estimate their price then

- 3Compare with today's price and calculate the increase

- 4Compare this increase percentage with your salary increase percentage

Example:

- Milk (1 litre): ₹42 (2020) → ₹65 (2025) = 55% increase

- Auto minimum fare: ₹18 (2020) → ₹25 (2025) = 39% increase

- School fee: ₹65,000 (2020) → ₹95,000 (2025) = 46% increase

Questions to ask:

- Did your salary increase by the same percentage?

- If you had ₹10,000 in savings in 2020 earning 3%, what happened to its purchasing power?

LEARNING OUTCOME:

This exercise builds the foundational skill of seeing inflation as a personal reality, not an economic abstraction. Most people know 'prices go up' intellectually, but they don't viscerally understand that their saved money is shrinking in real terms. By tracking specific prices in your own life over time, inflation becomes concrete and observable. You realize: my ₹50,000 in the bank hasn't changed as a number, but what it can do has changed dramatically. This awareness is critical because it shifts the question from 'Should I save?' to 'Where should I put money so it grows faster than prices rise?'

Smit Panchal

Chartered Accountant | Writing about Money, Clearly

Smit simplifies complex money concepts through first-principles thinking and real-world insights. Writing on personal finance, wealth frameworks, and financial clarity—beyond noise, products, and hype. Views expressed are personal and educational.

Connect on LinkedIn