Financial Planning First. Products Later.

Your Financial Life.

Planned, Not Pitched.

We help India's emerging investors make disciplined financial decisions — through education, tools, and long-term thinking.

Latest Knowledge

What We Help You Decide

Comprehensive financial guidance across the four pillars of wealth.

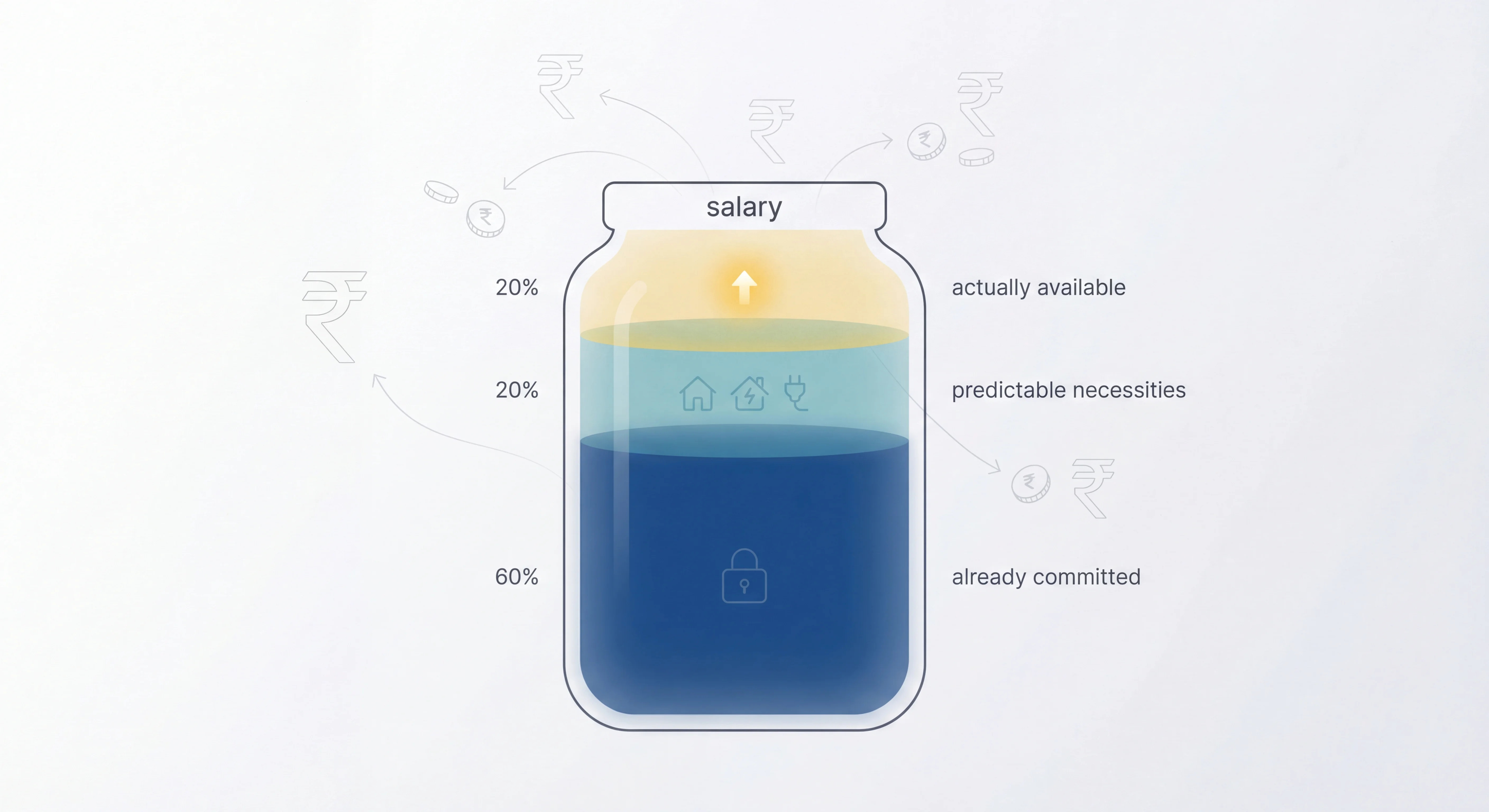

Personal Finance

Income, expenses, protection, and stability — the foundation before investing.

Investing

Asset allocation, mutual funds, and long-term compounding — without speculation.

Education

NISM, SEBI, and structured learning for those entering finance seriously.

Decision Tools

Using data, AI, and models to think better — not trade faster.

Why Trust

VanshSimplified?

In an industry driven by noise, urgency, and product pushing, VanshSimplified stands for something slower — and more durable.

- Educator-first, not commission-first

- Long-term financial preservation over short-term returns

- Data-backed reasoning, not opinions

- Technology as support, not replacement for judgment

The Power of Consistency

Visualizing compound growth over time